Introduction

The continent of Africa can boast the world’s youngest and fastest-growing population, but its long-term economic growth has been slow. With 1% annual growth in GDP, all expectations of a promising future have been deceived. Despite this, Africa can still achieve growth and benefit from digitalization, expanded regional collaboration, infrastructure investment, and (business) talent cultivation. Based on this, the purpose of the report “Reimagining Economic Growth in Africa” is to acknowledge Africa’s vital global role, analyze its progress from 2000 to 2019, and be mindful of the intrinsic diversity within the African continent, bringing up the assets and potentials for its sustainable growth.

The downshifted growth of Africa

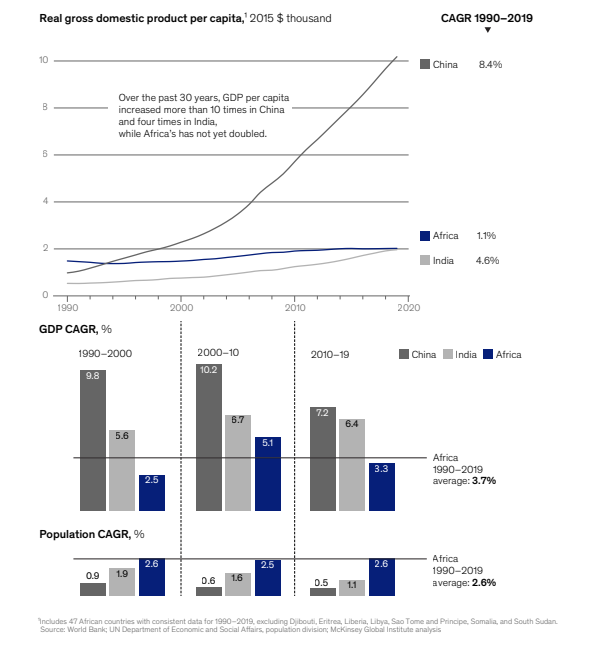

Sadly, the tailwinds that carried many growing economies into the new millennium, like broad corporate moves and offshore operations, did not favor Africa. According to the report, the gap is quite shocking: from 1990 to 2019 Africa’s GDP per capita grew only by 1%, compared to 5% in India and 8% in China. However, looking closer to single decades, it can be seen how Africa’s economic growth has been experiencing up and down moments, which can be summarized as:

- From 1990 to 2000, Africa’s GDP grew only by 2.5%.

- From 2000 to 2010, the country’s economy experienced a boost, and the GDP grew fast to 5.1%.

- Since 2010, unfortunately, Africa’s progress experienced an arrest, due to a deteriorating economy, increased political instability, and price shocks.

- From 2019, while its economy is now recovering from the pandemic, rising prices are still a challenge.

Overall, political instability has influenced Africa’s economic growth. Furthermore, it has increased steadily in the continent. According to the McKinsey Global Institute, 30% of Africa’s population is in a situation of political instability (2010-19).

Developing sustainable and resilient agrifood value chains in conflict-affected contexts by FAO

Africa’s Inner Divergence

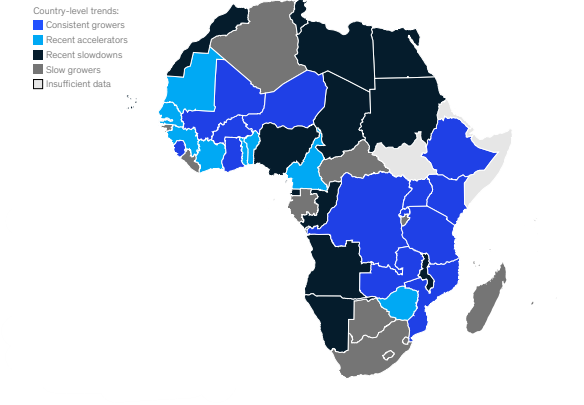

There is no such thing as “one African economy” across a broad, fragmented continent with low levels of intraregional trade. According to McKinsey’s report, countries in Africa can be divided into the following categories:

Consistent growers: About 41% of Africa’s population lives in countries (mostly in the East and West of Africa) belonging to this category. These countries’ growth rate is up to 4.2 % per year, from 2000 to 2019. Growth is still expected to continue in the future for these countries. Additionally, a reduction in the population percentage living in absolute poverty is expected.

Recent accelerators: Countries belonging to this category did not perform in the first decade of the century, but with a 7% GDP growth, are now exceeding Africa’s growth rate from 2010-19. The population living in poverty has declined, but the absolute number has increased.

Recent slowdown: Some of Africa’s big economies belong to this category and are home to 37% of the African population. Their growth arrest since 2010 can be addressed by lowering exports and investment combined with population growth, which also increased poverty.

Slow growers: With an average annual growth close to zero, 13% of the African population lives in countries belonging to this category. Compared to 2010, 8 million more people live now in poverty.

Drivers to Africa’s countries’ growth (or decline)

Incredibly, Africa’s decrease in growth is a large (about 65%) responsibility of the “big three”: Egypt and Nigeria are among the recent slowdowns, and South Africa is among the sluggish growers. Countries that have failed to grow have lower productivity rates and miss growth drivers such: as increased investments, exports, urbanization, and technological advantage.

Furthermore, while the growing population could be seen as a challenge, it could be seen as an asset and opportunity to meet the growing global manpower shortfall.

Africa’s urbanization trends

According to McKinsey’s report, by 2040 Africa’s by 2040, Africa will have 31 cities—19 more than today—counting more than five million people, keeping up the trend of the fastest urbanizing continent. In general, urbanization is a critical driver of economic progress, particularly in low-income countries, in fact, primary cities show:

- Better employment opportunities.

- Households earned and consumed more than twice as much as the rest of Africa.

- Only 2% of households are poor, compared to 9% in the rest of Africa.

-> Furthermore, second cities show the biggest opportunity for growth, as their status now is not as good as primary cities. Investments in these areas should focus on attracting investment, building infrastructure and affordable housing.

-> Finally, it should not be forgotten that Africa lacks infrastructure, and investment in improving it should be made. It is estimated that such investment would add up to 8.6% of GDP annually.

Africa’s economies are shifting rapidly

Over the last 20 years, the African economy has seen a major structural shift to services. Despite this transition, employment in services expanded from 30% to 39%, with agriculture still employing half of the African workforce in 2019. In the future, the continent will have the people’s capital and resources it requires to fuel growth and boost productivity across all sectors, beginning with the services sector. Services have established themselves as the primary driver of the continent’s economic output, accounting for 56% of total output in 2019 compared to 50% in 2000.

Africa’s large companies’ potential for growth

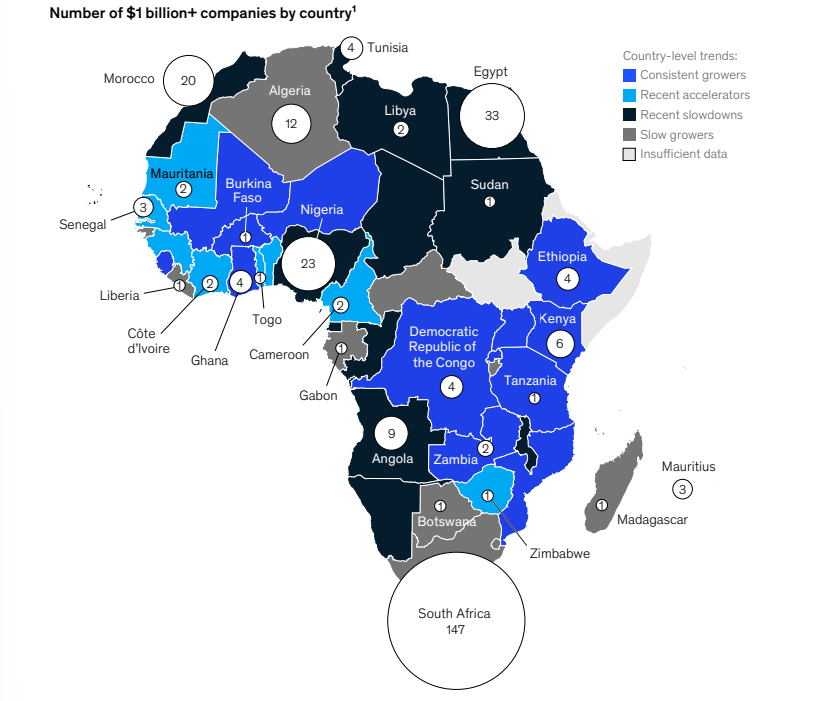

Africa is home to at least 345 companies whose annual revenues reach $ 1 billion (Fig.3). Most of these companies (230) were instituted in African countries, and are based on oil and gas, mining, retail, finance, manufacturing, or telecommunications. According to McKinsey’s report, these large companies play big roles in the economic progress of the continent, and while their performance varied between 2015 and 2021, they contributed to raising Africa’s productivity and proved to be resilient in the face of challenges.

Despite the resilience, since 2015 Africa lost 16% of >$ 1 billion revenue companies, with the best-performing sectors being power, utilities, agriculture, and mining. However, the report estimated that 50% of the 345 companies can feasibly boost their revenues for an overall amount of up to $550 billion by 2030, which highlights the role of big companies in Africa. To harvest growth, successful partnerships, strategies, and the inclusion of environmental, social, and governance goals will be strictly needed.

Fostering growth in Africa

Africa’s governmental and private sector decision-makers confront an exceptional chance to restart growth and re-establish the continent on a path of robust, sustainable, and inclusive development. This will not be easy: it will necessitate creativity, investment, and collaboration. Especially in light of the issues of climate change and energy transition. By recognizing that there is not “one Africa” McKinsey’s report identified ten practical ways for businesses and governments to boost economic growth and productivity:

- Pivot from a focus on growth for growth’s sake to a focus on productivity.

- Fully embrace digital technologies and systems in all areas of the economy.

- Develop African talent to serve Africa and the world.

- Reimagine manufacturing for domestic consumption and for export in a competitive way.

- Increase regional connectedness.

- Invest to enhance resource productivity and tap into new opportunities.

- Explore opportunities to benefit from the global net-zero agenda.

- Spur the agricultural transition by improving farming productivity.

- Increase and improve urban infrastructure in Africa’s primary and second cities.

- Grow and cultivate African business champions.

To understand what each step truly means in detail, read the full report here.

Source

McKinsey Global Institute. (2023). Reimagining economic growth in Africa – Turning diversity into opportunity. https://www.mckinsey.com/mgi/our-research/reimagining-economic-growth-in-africa-turning-diversity-into-opportunity#/

Related articles to Reimagining economic growth in Africa

Many customers and visitors to this page 'Reimagining economic growth in Africa ' also viewed the articles and manuals listed below: