Introduction Made by Africa: creating value through integration

Africa has great potential, and the African Continental Free Trade Area (AfCFTA) is a crucial cornerstone for unlocking it. To take advantage of continental opportunities and get rid of obstacles in key industries, it is important to set priorities, guide actions in the right direction, and create value.

Africa’s international market impact is relatively limited. Africa accounts for only 2.3% of world exports, primary commodities, and natural resources. While only 14% of the continent’s exports are to other African countries, a large portion of this trade is in semi-processed and processed commodities. Thus, regional commerce must be strengthened in order to promote higher value addition, diversify supply chains, increase resilience to crises, and industrialize. This will ultimately contribute to job creation and improved livelihoods on the continent.

This report by the International Trade Centre (ITC) investigated value chains in order to discover high-potential industries for African sustainable development as well as barriers for enterprises. The value chain diagnostic assists the continent by advising governments and businesses on how to create long-term value chains.

Value chain priorities

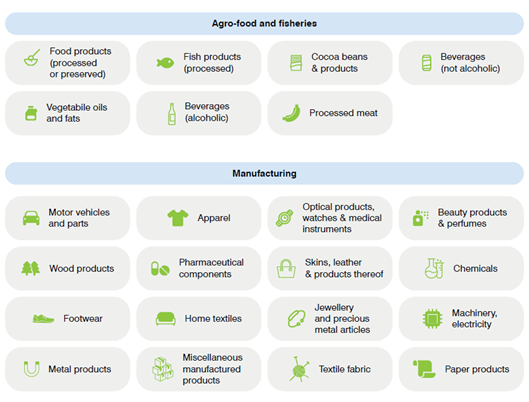

The data analysis identified 94 attractive, achievable value chains at the continental level from 415 options (Figure 2). After further examination, the diagnostic ultimately determined four pilot strategic sectors: automobiles, pharmaceuticals, cotton apparel, and baby food, which are represented in Figure 2.

Pharmaceuticals value chain

With Africa supplying only 3% of imported inputs, a big trade imbalance, a high and increasing import dependency, and a COVID-19-induced call for increased self-reliance. Thus, there is a massive policy drive to boost Africa’s pharmaceutical sector. Therefore, global pharmaceutical companies are targeting Africa, and efforts to establish manufacturing facilities are underway.

Automotive value chain

This value chain offers a lot of intraregional trading possibilities. A vast and rising continental market; the ability to connect with value chains such as leather and electrical machinery, and growing partnerships with overseas corporations. Therefore, the sector offers a variety of investment opportunities.

Cotton apparel value chain

Africa is the top cotton producer in the world. It contributes 10% of the global cotton trade and has a considerable opportunity to add value in the intermediate steps of the value chain, such as yarn and fabrics. Thus, making it an attractive investment sector.

Infant food value chain

Despite the abundance of locally available food sources, Africa’s reliance on imports makes localized sourcing and manufacturing a good choice. It is also an ideal industry for small businesses and a source of employment for women.

Challenges

Table 1: Challenges in pilot value chains. Source ITC 2022

African businesses

ITC 2022

- In the four pilot value chains, only 7% of total sales, on average, stem from intraregional exports.

- Cross-border business operations are low, at 28%. Firms are dissatisfied with the pace of implementation of trade agreements. Awareness of the continental trade agreement is modest.

- Fewer than 10% of the interviewed companies participated in public–private consultations on trade agreements before the adoption of the AfCFTA.

However, the African business community actively sustains endeavors to develop sustainable regional value chains.

Challenges

Lack of trust in product quality

This lack of trust diminishes the incentives for sourcing locally. Moreover, a solid quality management structure is required across the continent. African input providers and output manufacturers frequently do not know one another due to a lack of trust. Nevertheless, this prevents them from connecting and establishing commercial relationships, and thus African producers instead obtain supplies from Europe and China.

Building trust in regionally manufactured goods requires reinforcing quality standards, maintaining adherence through effective enforcement and capacity building, establishing a solid conformity-assessment infrastructure, and harmonizing quality standards across nations. Furthermore, transparency in market access criteria and trade-related procedures can assist businesses in identifying and leveraging market possibilities in Africa.

Poor access to finance and high production costs

High loan prices are a significant barrier to expenditures in R&D, new technologies, and worker skills. They also make it difficult for businesses to adhere to quality standards and ecologically friendly manufacturing procedures. Thus, these impediments hinder investment, limit economies of scale, and render African commodities uncompetitive.

Weak connectivity

Inefficient logistical networks and fragmented transportation channels hamper cross-border trade. The lack of reliable credit lines for cross-border transactions, together with non-tariff regulatory barriers, further impedes regional trade.

Therefore, better connectivity necessitates investments in a reliable transportation network, enhanced trade agreement implementation, the elimination of needless trade restrictions, and tighter border clearance procedures. Furthermore, investing in safe and reliable payment networks between countries will encourage businesses to look for regional sourcing opportunities.

Circular economy

Environmental challenges require investments in appropriate technologies and methods. African firms are well aware of the hazards posed by climate change. Yet, regional demand for eco-friendly products is modest. Nevertheless, the large carbon footprint of manufacturing processes, the lack of effective waste management systems and regulations, and the limited access to green technologies all require careful consideration.

A way forward

To support the development of innovative and sustainable value chains on a continental scale in Africa, a comprehensive action plan is required. An ecosystem for future integration should include the following:

- Define a continental strategy

- Create an enabling environment for value chain integration

- Provide evidence on sector-specific challenges and recommendations

Sources

International Trade Centre (2022). Made by Africa: Creating Value through Integration. ITC, Geneva.

Related articles to Made by Africa: creating value through integration

Many customers and visitors to this page 'Made by Africa: creating value through integration' also viewed the articles and manuals listed below: