Introduction

The European TICCS market is rapidly transforming, driven by evolving consumer expectations and stricter regulations. While this growth presents new opportunities, it also raises concerns about market consolidation and potential monopolies, particularly in the Netherlands where French companies have established dominance.

This article examines the current state of the Dutch TICCS market, exploring the implications of French dominance and the challenges and opportunities facing food businesses. It offers guidance on navigating this evolving landscape and highlights solutions that empower companies to take control of their food safety management and mitigate risks.

What is Testing Inspection and Certification (TIC)

At its core, TIC in the food industry is about safeguarding consumers and upholding brand integrity:

- Testing ensures that food products meet stringent safety standards by identifying potential contaminants or pathogens

- Inspection verifies the hygienic conditions of production facilities and ensures products meet quality benchmarks

- Certification provides an official stamp of approval, assuring consumers and regulators that a product or process adheres to established guidelines

More than just tests (TICCS)

In recent years, the growing need for comprehensive solutions drove the TIC market to expand also in different directions, resulting in “Testing Inspection Certification Consultancy Software” (TICCS):

- Consultancy services offer expert guidance on navigating complex regulations, optimizing processes, and implementing effective food safety management systems

- Software solutions streamline data collection, analysis, and reporting, enhancing efficiency and transparency throughout the supply chain

Expected Market Growth and Key Drivers

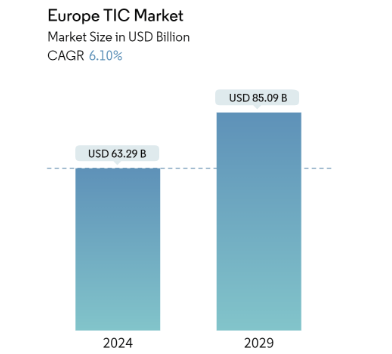

The European TIC(CS) market is expected to grow significantly, with projections estimating it to reach USD 85.09 billion by 2029, exhibiting a robust CAGR of 6.10% from 2024 to 2029 [1] (Figure 1).

-> This growth is fueled by several factors:

- Rising Consumer Demand: Consumers are increasingly concerned about food safety and quality, pushing companies to invest in TICCS to meet these expectations [2]

- Complex Global Supply Chains: The globalization of food production and distribution necessitates robust TICCS solutions to manage risks and ensure traceability [2]

- Technological Advancements: New technologies are enabling faster, more accurate, and efficient testing and inspection methods, driving innovation in the TICCS market [2]

- Stricter Regulations: The European Union’s stringent food safety regulations are driving demand for comprehensive TICCS services to ensure compliance [1]

A French Wave in the TICCS Dutch Market

Recent acquisitions in the Dutch TICCS market, including the notable purchase of Normec by a French company, are indicative of a broader trend of consolidation in Europe. This increasing concentration of ownership raises concerns about fair competition, pricing, and service diversity. The growing dominance of French investors in the Dutch market, as illustrated in Figure 2, highlights the need for proactive measures to safeguard market diversity and consumer interests.

ARR: The Driving Force Behind French Investments

French investors are attracted to the food TICCS market due to the promise of stable Annual Recurring Revenue (ARR). Various services within the TICCS sector contribute to this consistent revenue stream:

- ARR1: Testing: Laboratory research schedules generate recurring revenue through ongoing testing needs

- ARR2: Inspection: Regular checks of raw materials at ports, customer sites, or through self-checking systems in food service establishments ensure continuous income

- ARR3: Certification: GFSI certifications and similar programs often involve recurring audits and renewals, contributing to ARR

- ARR4: Consultancy: Ongoing support for GFSI certification, interim quality assurance, and label checks typically involve annual agreements, providing a stable revenue source

- ARR5: Software: Licensing fees for quality assurance software, often integrated into consultancy services, further enhance ARR by creating customer dependency

Trends for Major Players of the Dutch TICCS market

Notably, since 2019, French investors have strategically focused on acquiring consultancy firms, recognizing their potential for generating ARR. More recently, there’s been a shift towards acquiring sustainability assessment services like life cycle assessment, further solidifying their recurring revenue base.

The following timeline illustrates the acquisitions by major players in the Dutch food safety market, highlighting this trend towards consolidation and a focus on consultancy and sustainability assessment services:

- 2023: Eurofins acquires WFC Analytics (consultancy)

- 2019: Merieux NutriSciences acquires KTBA (consultancy)

- 2019: Normec acquires Kroonenburg and N&S Quality Consultants (both consultancy)

- 2023: Merieux acquires Blonk (life cycle assessment)

The Impact of TICCS on Food Safety and Sustainability

The Dutch food safety consultancy market is now predominantly controlled by French investors, who also hold a significant share in testing laboratories. While consolidation can improve efficiency, it raises concerns about potential conflicts of interest, reduced competition, and a narrow focus on recurring revenue that may overshadow critical food safety issues and stifle innovation.

For food companies, this evolving landscape necessitates vigilance and awareness of the potential negative impacts of consolidation. However, it also presents an opportunity to leverage the growth of TICCS in Europe to enhance food safety and quality. By addressing challenges and embracing opportunities, the industry can ensure safe, high-quality food products while supporting sustainable practices.

Navigating the TICCS Market: A Guide for Food Companies

To thrive in this environment, companies need to adopt a strategic approach to managing their TICCS needs:

- Maintain in-house food safety expertise to effectively evaluate and manage external providers

- Diversify TICCS providers to mitigate risks and access a wider range of expertise

- Invest in continuous training and development for your team

- Embrace technological advancements in the TICCS market

iMIS Food

In the evolving TICCS market, companies are increasingly seeking integrated solutions for streamlined food safety and quality management. IMIS Food, a comprehensive cloud-based software platform (Figure 3), is a valuable tool for navigating this complex landscape. With iMIS Food, the only Dutch food Safety platform, you can manage food safety yourself and you contribute to keeping food safety knowledge in the local ecosystem.

Key advantages of iMIS Food include:

- Centralized Data Management: Consolidating all food safety and quality data into a single platform

- Enhanced Efficiency: Automating routine tasks and streamlining workflows

- Real-Time Insights: Generating reports and dashboards for informed decision-making

- Proactive Risk Management: Facilitating risk assessment and mitigation

- Regulatory Compliance: Supporting compliance with various food safety regulations and standards

Sources

- [1] Europe TIC Market Insights. (n.d.). https://www.mordorintelligence.com/industry-reports/europe-testing-inspection-and-certification-market

- [2] Straits Research. (2021). Europe Testing, Inspection and Certification (TIC) market share, demand to 2030. https://straitsresearch.com/report/testing-inspection-and-certification-tic-market/europe

Related articles to The Shifting Landscape of the European TICCS Market: A Focus on the Netherlands

Many customers and visitors to this page 'The Shifting Landscape of the European TICCS Market: A Focus on the Netherlands' also viewed the articles and manuals listed below: